While forex trading itself may not be operationally difficult, the financial analysis of markets is. Placing an order in the broker’s trading platform is really not a problem – but which asset should you choose? Which stop-loss/take profit setting? Will the underlying asset price rise or fall? Everyone will agree that financial analysis makes all the difference for those who really want to be successful traders. This is also the area where most people get scared and simply decide to either not trade anymore or mindlessly push “Buy” or “Sell” until their balance is down to zero. This is what leads many to start thinking about alternatives – what if there were systems that could help traders skip the financial analysis and go directly to (hopefully) profits? What if we told you there were such solutions?

At this point its important to take the whole idea of automatic forex profits with a grain of salt. Yes, there are automated trading systems that work with forex trading platforms and achieve certain results in certain conditions, but one has to be careful and do proper research. Internet is such a vast space filled with various offers. Some of them advertise instant riches and guaranteed profits, while others focus on the technical side of forex trading and require a little effort to get them to work. Guess which ones present a more legit way to do automatic trading?

Forex Expert Advisors in MetaTrader Platform

If you already have an account with one of the many forex brands, it is also very likely you are using MetaTrader as your platform of choice. If you mastered MetaTrader you have a pretty good idea that it can do many things other than just place trades and watch charts. The platform is supported by a community which develops all kinds of plugins and add-ons which make MetaTrader ecosystem so popular. One of such features is the Expert Advisor feature which enables automatic trading.

The idea is basically to have a program, a piece of code, that becomes part of the trading platform and it can automatically spot opportunities in the market and use them to place trades. Expert Advisors, or EAs, use coded strategies which can also be customized by changing various parameters in order to spot and place trades on behalf of the trader. Because of this automatic nature of the EAs, they are also often called forex robots.

For most customers that look for a forex robot, an EA is the first and obvious solution, until they try to figure how to get one to work.

The first step is selecting the forex robot – an EA from the MetaTrader Market. It’s a website that lists probably most of all the existing EAs and allows to browse them and check basic info. There are many, under different price points and using various strategies. Obviously one can use the free one or a paid one. Maybe for the beginner, a free system that can be used to test the technical implementation on a demo account is a way to go. You don’t want to be paying money for something you even don’t know how to implement yet.

Those who feel confident will immediately notice that the paid section has many offers, from few USD to several hundred or even thousands of dollars. Some due diligence is needed here. It’s advisable to check the EA thoroughly before buying one. The description of the EA in the Market will state the basic strategy and environment its meant to operate in and conditions traders might need to meet to obtain one. It will describe how the trade settings such as stop-loss or take profit are used and also list the main currency pairs it tracks. Parameters will also be specified most of the times. Importantly it will also show statistics on its simulated performance. Overall some will have a vast documentation, while others will not go that deep into describing the robot, parameters and features.

Each EA also has a 1-5 star review and buyers will likely leave comments about their experience. Comments section is usually a bit richer in feedback and a lot more information is available from other users of the EA there. In case this is a new forex robot in the Market, it might take a while for it to get this kind of feedback.

Next is the implementation. This is where many beginners get stuck since they mostly expect simple switch or installation, but it takes some work. Here are the basic steps if you use MetaTrader4 Terminal.

- Download and get mq4 file of EA from the Market

- Run MetaQuotes Language Editor (F4)

- Right click experts on the side and click open folder to access the folder with EAs

- Place the *.mq4 file you downloaded in the folder you just opened

- Close the language editor and MetaTrader4 Terminal

- Open MetaTrader4

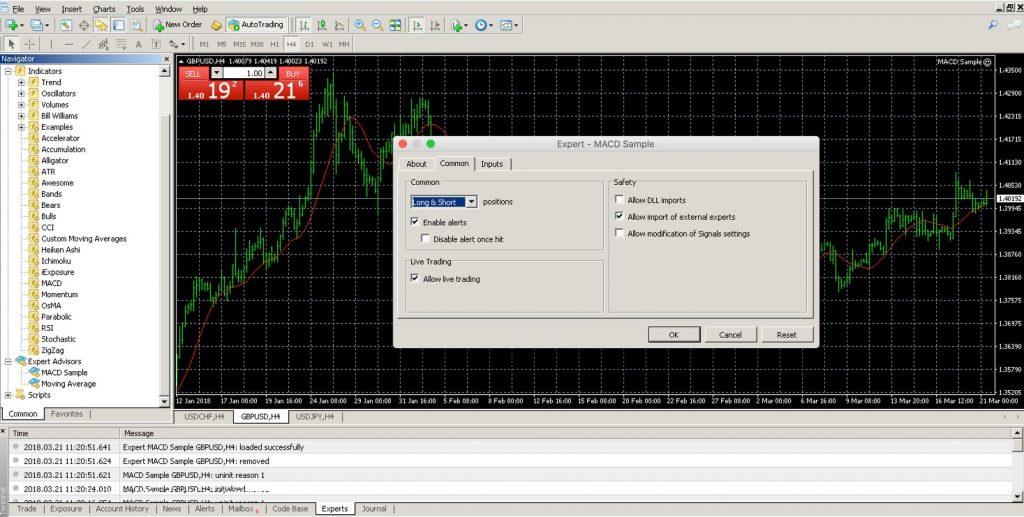

- In the navigator in the bottom left, click on Expert Advisors to get list of EAs installed

- Enable Automated Trading button in the top

- Go to tools -> options -> Expert Advisors and check “Allow DLL imports”

- Drag and drop the Expert Advisor from the list on the chart

- Set preferences in the menu (Common/ Inputs)

- If all is fine you will have a smiley in the upper right corner of the chart

You can also see how it works in this youtube video.

Overall, when selecting an EA, make sure you to check all the available information and also take a look at documentation on how to test the EA before buying.

Web-based Forex Robots

This is a category that encompasses many types of products which all have several things in common:

– usually they are free

– the platform used is web based

– customers need to deposit with a broker that only works with that robot

– signals are less reliable and hard to verify

– easy to use

Meanwhile such products do not deal with currencies, they also claim to trade cryptocurrency pairs. These products are less transparent and, so far the reviews of such automated forex or CFDs trading robots have not really concluded that the returns are to be expected most of the time, or they just focus on the features, not mentioning returns.

The worst kind are probably websites that “guarantee” huge returns, call themselves something like “FX profit generator” or “Millionaire Secret Code”. It is pretty clear that most traders should not believe in this kind of promotional activity. After one creates an account, a broker, mostly unregulated and not well known, is assigned and customer needs to deposit money there before they can turn on the “auto trading” switch and see trades being placed in their behalf.

Some other products really offer nice interfaces and one can even manually select trading recommendations to be placed with the broker. In most cases signals generated by such systems are unfortunately not of highest quality. There have been rumors that if one spots the asset that the forex robot performs well in, all other assets should be deselected in order to block those signals from being traded, thereby getting the overall win rate higher. But this is also very high to verify without actually investing money and trying. Many of such auto trading robots even work with reputable brokers which have licenses – this at least reduces the chances of fraud.

In conclusion, one can find many forex automatic trading systems online. Make sure to beware of the promises they make and always try to see if the results can be verified. This goes especially for the EAs where prices can reach thousands, or “make money” websites where deposits are lower, but the auto trading software is just a facade to get people to deposit with a broker. In any case, beginners should consider studying technical analysis and trading manually on demo accounts to see for themselves that profits never come easy.

Speak Your Mind