EUR/USD Daily Analytics

14:03 07.11.2017

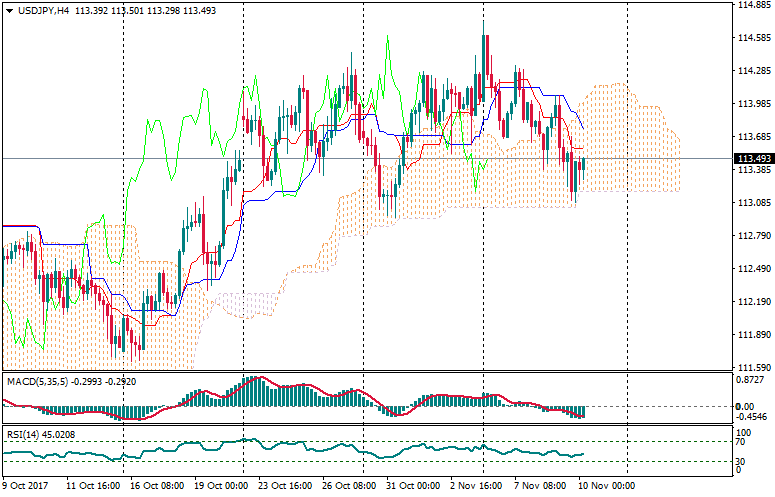

The last "Shooting Star" led to the current decline. Also, there isn't any reversal pattern so far. If the 21 Moving Average acts as resistance, we're likely going to have just another decline.

We don't have any reversal pattern for now. Yesterday, we had a "Tweezers" pattern, so there's a new local low. In this case, the pair is likely going to test the nearest support area during the day.

More:

https://fbs.com/analytics/articles/eur-usd-shooting-star-led-to-decline-4928

14:03 07.11.2017

The last "Shooting Star" led to the current decline. Also, there isn't any reversal pattern so far. If the 21 Moving Average acts as resistance, we're likely going to have just another decline.

We don't have any reversal pattern for now. Yesterday, we had a "Tweezers" pattern, so there's a new local low. In this case, the pair is likely going to test the nearest support area during the day.

More:

https://fbs.com/analytics/articles/eur-usd-shooting-star-led-to-decline-4928