United States Crude Oil Inventories October 20 2021

What does the data mean to the market?

The data indicates the number of crude oil barrels held by commercial firms in the US; this inventory is taken weekly and shows increases or decreases needed in supply, affecting the price. Therefore, a Positive number is bad for the oil price and vice versa.

Other oil data is released the night before this report, API Weekly Crude Oil Stock, which the market looks for as an indicator of today's announcement, which can gauge how it will respond, so it's worth keeping an eye on that also.

There are two mainline of data to focus on. The two lines of DOE Gasoline Inventories and DOE Crude Oil Inventories must not conflict to make this data tradable; Oil is the driving force behind this report.

Historic deviations and their outcome

September 22 2021 A reasonable size deviation from oil just short of my trigger but with a conflict from Gasoline it wasn't a trade for me, Although seeing a nice 30 pip move which continued after that. The risk of ignoring gasoline is too great.

Check out the price action here:

September 15 2021 Sizeable deviation from Crude Oil, unfortunately, Gasoline conflicted, and therefore it wasn't a trade for me.

Check out the price action here:

September 1 2021 Today we saw a sizeable deviation from oil, but with a conflict from gasoline. Still, we saw a healthy 40 pip spike before it returned to pre news level. Not trade for me.

Check out the price action here:

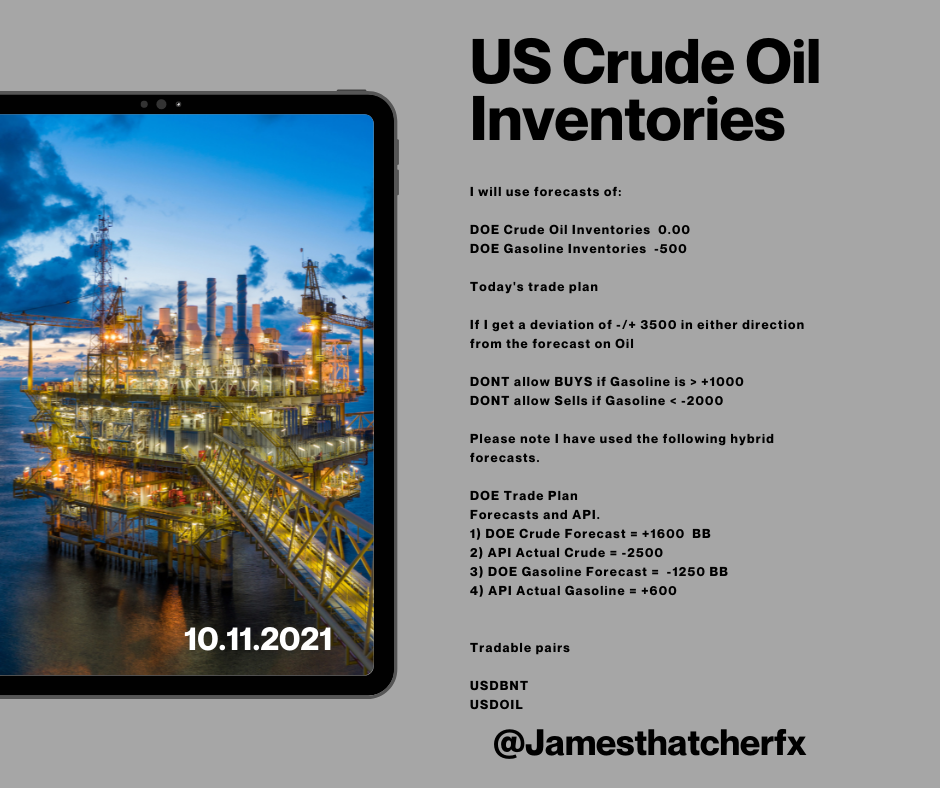

I will use forecasts of:

DOE Crude Oil Inventories +2750

DOE Gasoline Inventories -2000

Today's trade plan

If I get a deviation of -/+ 3500 in either direction from the forecast on Oil

DONT allow BUYS if Gasoline is > 0

DONT allow Sells if Gasoline < -3500

Please note I have used the following hybrid forecasts.

DOE Trade Plan

Forecasts and API.

1) DOE Crude Forecast = +2000 BB

2) API Actual Crude = +3300

3) DOE Gasoline Forecast = -950 BB

4) API Actual Gasoline = -3500

Tradable pairs

USDBNT

USDOIL

Hope this helps but please do your own analysis!!

Good luck!!

James Thatcher

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

What does the data mean to the market?

The data indicates the number of crude oil barrels held by commercial firms in the US; this inventory is taken weekly and shows increases or decreases needed in supply, affecting the price. Therefore, a Positive number is bad for the oil price and vice versa.

Other oil data is released the night before this report, API Weekly Crude Oil Stock, which the market looks for as an indicator of today's announcement, which can gauge how it will respond, so it's worth keeping an eye on that also.

There are two mainline of data to focus on. The two lines of DOE Gasoline Inventories and DOE Crude Oil Inventories must not conflict to make this data tradable; Oil is the driving force behind this report.

Historic deviations and their outcome

September 22 2021 A reasonable size deviation from oil just short of my trigger but with a conflict from Gasoline it wasn't a trade for me, Although seeing a nice 30 pip move which continued after that. The risk of ignoring gasoline is too great.

Check out the price action here:

US Crude Oil Inventories 2021-09-22 14:30:00.0

US Crude Oil Inventories 2021-09-22 14:30:00.0

calendarapi.galaxysoftwareinc.com

September 15 2021 Sizeable deviation from Crude Oil, unfortunately, Gasoline conflicted, and therefore it wasn't a trade for me.

Check out the price action here:

US Crude Oil Inventories 2021-09-15 14:30:00.0

US Crude Oil Inventories 2021-09-15 14:30:00.0

calendarapi.galaxysoftwareinc.com

September 1 2021 Today we saw a sizeable deviation from oil, but with a conflict from gasoline. Still, we saw a healthy 40 pip spike before it returned to pre news level. Not trade for me.

Check out the price action here:

US Crude Oil Inventories 2021-09-01 14:30:00.0

US Crude Oil Inventories 2021-09-01 14:30:00.0

calendarapi.galaxysoftwareinc.com

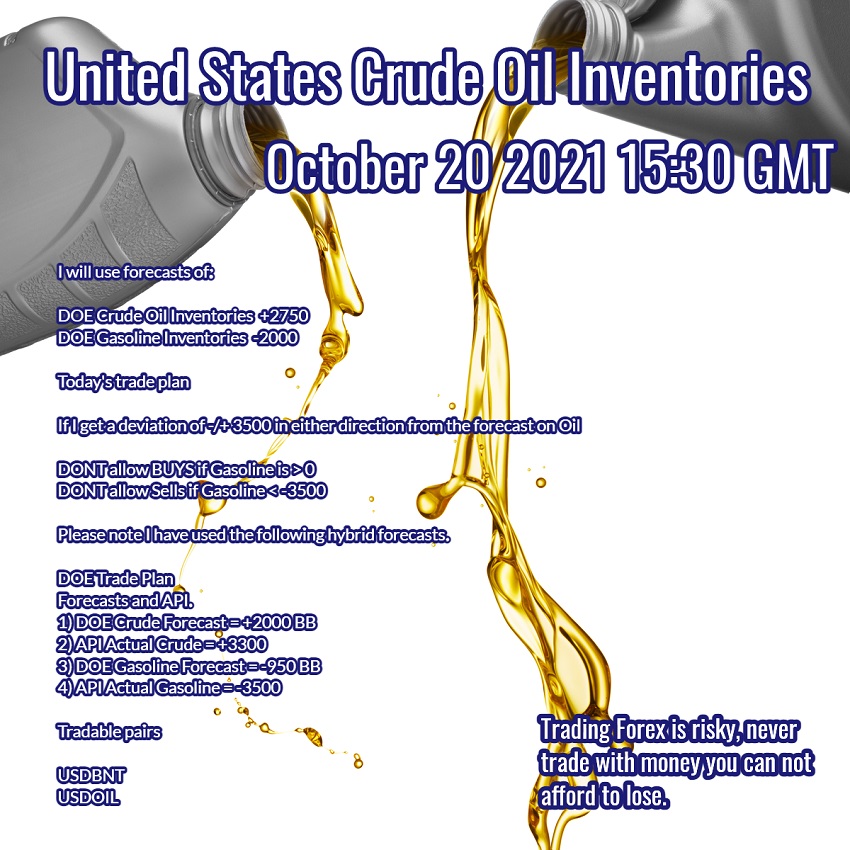

I will use forecasts of:

DOE Crude Oil Inventories +2750

DOE Gasoline Inventories -2000

Today's trade plan

If I get a deviation of -/+ 3500 in either direction from the forecast on Oil

DONT allow BUYS if Gasoline is > 0

DONT allow Sells if Gasoline < -3500

Please note I have used the following hybrid forecasts.

DOE Trade Plan

Forecasts and API.

1) DOE Crude Forecast = +2000 BB

2) API Actual Crude = +3300

3) DOE Gasoline Forecast = -950 BB

4) API Actual Gasoline = -3500

Tradable pairs

USDBNT

USDOIL

Hope this helps but please do your own analysis!!

Good luck!!

James Thatcher

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.