Hello,

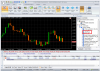

We have converted an Expert Advisor Catching Gaps for Vertex FX. Catching Gaps is a very powerfull Expert Advisor for VertexFX that catches the gaps and use it to place orders and generate profit.

The EA opens a trade when there is a price gap. Gaps are usually found when new market session is opened (market opening). The minimum gap size and lot size are defined in parameter. Catching Gaps will open orders if the gap is more than min gap size set in the parameter.

There are two paramenters. The first parameter is min_gapsize which is minimum gap size in points. This parameter by default is set to 1. The second parameter is lotsize_gap, which is number of lots to be traded; catching gaps EA will open for all orders. For every new bar, EA calculates the gap between current open price and previous high, also between current open price and previous low.

traders can place buy positions when Current Open Price is lower than previous low. Place take profit at previous low, also traders can place sell position when Current Open Price is higher than previous high. Place take profit as previous high.

We have converted an Expert Advisor Catching Gaps for Vertex FX. Catching Gaps is a very powerfull Expert Advisor for VertexFX that catches the gaps and use it to place orders and generate profit.

The EA opens a trade when there is a price gap. Gaps are usually found when new market session is opened (market opening). The minimum gap size and lot size are defined in parameter. Catching Gaps will open orders if the gap is more than min gap size set in the parameter.

There are two paramenters. The first parameter is min_gapsize which is minimum gap size in points. This parameter by default is set to 1. The second parameter is lotsize_gap, which is number of lots to be traded; catching gaps EA will open for all orders. For every new bar, EA calculates the gap between current open price and previous high, also between current open price and previous low.

traders can place buy positions when Current Open Price is lower than previous low. Place take profit at previous low, also traders can place sell position when Current Open Price is higher than previous high. Place take profit as previous high.