FxGrow Daily Technical Analysis – 14th July, 2017

By FxGrow Research & Analysis Team

Futures Technical Overview Ahead of U.S Data Release

U.S is set to release multi inflation figure with CPI and Core CPI in focus. Yesterday, market reaction to Yellen speech was mostly neutral, but what make today's data vital is that Yellen couldn't deliver clear signs about two main issues driving the market. First coming rate hikes and U.S Federal balance sheet. Both, will be subject to economic cycle performance and data should be watched in case the U.S Fed could take a decision regarding them.

Hence, today's data will be watched closely by markets and based on results, traders will take action with expectation for high volatility than the previous days. The main focus will be on CPI and Core CPI as they have more impact on the interest rates in case a decision to be taken.

The Fed chair is not speaking Friday, but Yellen's surprising comments on inflation in congressional testimony this week make Friday's CPI an even hotter topic for markets than it normally would be. CPI is expected to rise by a slight 0.1 percent on headline inflation. (CNBC).

Technical levels for future currencies:

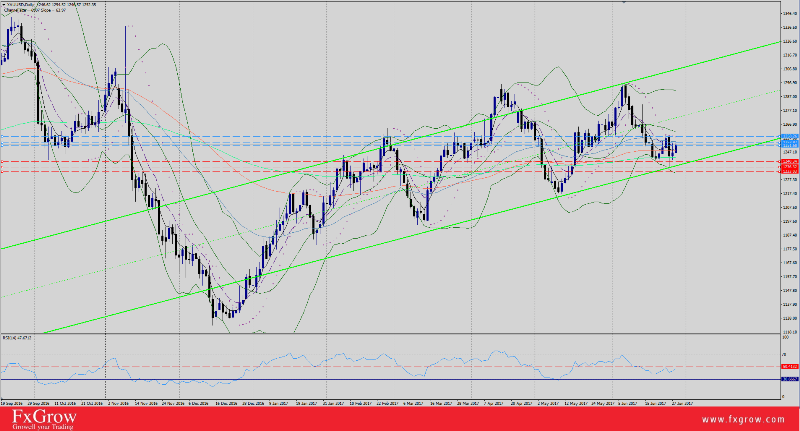

SEP B-POUND

Currently: 12971

Target: None

Resistance: 12977*, 13047+ 12933,

Support: 12894-90, 12849

Trend: Sdwys/Up

Trend Reversal: 1.2802

Comment The market remains short term bullish and yesterday's rally alerts for a preliminary upturn from recent corrections. Trade is poised to launch secondary rallies and a close over 12977* will spark a run to attack over the 13092 high. Any further dips should hold over Wednesday's low to keep a bull alignment. A drop under 12839 targets a drop to 12802* support.

SEP EURO

Currently: 114435

Target: 11580

Resistance: 11490, 11515+, 11580

Support: 11413-12, 11391*

Trend: Up

Trend Reversal: 113.085

Comment The market is bullish, still signaling for a run to 11580+. A pop over Wednesday's reversal high will spark the extension to 11580. Be prepared for additional near term corrective action today, but only a close under 11391* marks a near term peak and signals for retracements to attack 113085* for a larger downturn.

SEP J-YEN

Currently: 88545

Target: None

Resistance: 8879-8885, 8959*

Support: 8838, 8805, 8760-

Trend: Down

Trend Reversal: 8959

Comment: Overall the market is short term bearish. A roll off back through 8800- is negative. A close under the 8760 May low alerts for a larger bear wave near 8700. Wednesday's corrective action hints for near rebounds. A push over 8885 will boost rallies. A close over 8959* is needed to trigger a reversing turn and we should suspect a setback from 8959* on the first test.

SEP SWISS

Currently (10381)

Target: None

Resistance: 10411, 10444-57*,

Support: 10483 10380*-, 10326-

Trend: Sdwys

Trend Reversal Point: 103.80

Comment The market is still bullish and climb over last week's 10483 high or close over 10457* are needed to recapture bull forces and renew the projection to 10700+. However, note yesterday's close is against 10380* support which must hold to maintain bull trend forces. A close under 10380* is bearish, alerting for a selling wave under 10300-.

SEP US DOLLAR

Currently: (95508)

Target: 9507

Resistance: 95915, 9614, 96645*

Support: 9530-, 9507

Trend: Down

Trend Reversal: 96.645

Comment The market is bearish, still suggesting selloffs to reach for 9507. Last week's flagging action leaves trade ready to initiate the flagging downturn. A close under 9507 could add washouts to 9450-9400. Minor recovery action trapped inside this week's range will maintain bear forces. A rebound over 9596 is near term positive, but only a close over 96645* signals a lasting turn to higher prices.

SEP AUSSIE$

Currently: (7725)

Target: 7818

Resistance: 7818

Support:7699, 7685, 7668*

Trend: Up

Trend Reversal: 7627

Comment Yesterday's rally highlights a significant upside breakout and opens up potential for rallies to 7818. Trade is poised for aggressive rallies. Any corrective dips that hold within yesterday's range will maintain strong bull forces and create a staging level for rallies. Only a close under 7668* warns for a multi-day correction phase back down to 7627*.

AUG GOLD

Currently 121640

Target: 118920

Resistance: 122350-122420, 122830*

Support: 121460-00, 1208-, 119940

Trend: Down

Trend Reversal: 1238.60

Comment The market remains in a downturn and holds potential below 1200-. A flagging downturn from current corrections calls for aggressive selloffs. Near term corrections that stall in the 1220's will reinforce the bear pattern. A close over 122830* is needed to stop the downturn and send rallies to 123860*.

For more in depth Research & Analysis please visit FxGrow.https://goo.gl/9a4k9k

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.