Asia-Pacific and European Markets React to Rate Hike, XPeng Inc. Soars on Volkswagen Investment

Asia-Pacific shares mostly advanced on Thursday following the U.S. Federal Reserve's decision to implement a long-anticipated interest rate hike, pushing rates to their highest point in over 22 years. Despite this increase, the Federal Reserve indicated that further tightening measures might still be on the horizon. Likewise, European equity markets were poised to open higher on Thursday as investors prepared for the expected 25 basis point rate hike from the European Central Bank.

XPeng Inc. stood out as the top performer in MSCI Inc.'s Asia Pacific Index, with its stock surging over 30%. This impressive jump came after Volkswagen AG announced its intention to invest $700 million in the Chinese electric vehicle maker.

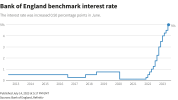

The Federal Reserve's interest rate hike was in line with expectations, raising the funds rate by a quarter percentage point, bringing the target range to 5.25%-5.5%. This marks the highest rate level in more than two decades. The central bank intends to assess how the previous rate increases affect economic conditions before deciding on further actions. Chairman Jerome Powell suggested that another rate hike might take place at the next meeting in September if economic data supports it. The post-meeting statement emphasized a data-dependent approach to monetary policy. The rate hike received unanimous approval from the voting committee members, and despite predictions of a mild recession, the statement referred to economic growth as "moderate," though inflation remains a concern.

Meanwhile, the market focus shifted to the European Central Bank's expected rate hike on Thursday, which would raise the main interest rate from 3.5% to 3.75%. Investors are keenly watching for signals regarding the bank's plans for its September meeting.

Euro area countries find themselves at different stages in their efforts to combat inflation, and there have been concerning signs from the economy, with business activity declining more than anticipated in July.

Asia-Pacific shares mostly advanced on Thursday following the U.S. Federal Reserve's decision to implement a long-anticipated interest rate hike, pushing rates to their highest point in over 22 years. Despite this increase, the Federal Reserve indicated that further tightening measures might still be on the horizon. Likewise, European equity markets were poised to open higher on Thursday as investors prepared for the expected 25 basis point rate hike from the European Central Bank.

XPeng Inc. stood out as the top performer in MSCI Inc.'s Asia Pacific Index, with its stock surging over 30%. This impressive jump came after Volkswagen AG announced its intention to invest $700 million in the Chinese electric vehicle maker.

The Federal Reserve's interest rate hike was in line with expectations, raising the funds rate by a quarter percentage point, bringing the target range to 5.25%-5.5%. This marks the highest rate level in more than two decades. The central bank intends to assess how the previous rate increases affect economic conditions before deciding on further actions. Chairman Jerome Powell suggested that another rate hike might take place at the next meeting in September if economic data supports it. The post-meeting statement emphasized a data-dependent approach to monetary policy. The rate hike received unanimous approval from the voting committee members, and despite predictions of a mild recession, the statement referred to economic growth as "moderate," though inflation remains a concern.

Meanwhile, the market focus shifted to the European Central Bank's expected rate hike on Thursday, which would raise the main interest rate from 3.5% to 3.75%. Investors are keenly watching for signals regarding the bank's plans for its September meeting.

Euro area countries find themselves at different stages in their efforts to combat inflation, and there have been concerning signs from the economy, with business activity declining more than anticipated in July.