GBP/NZD Technical Analysis for 09.05.2024

Time Zone: GMT +3

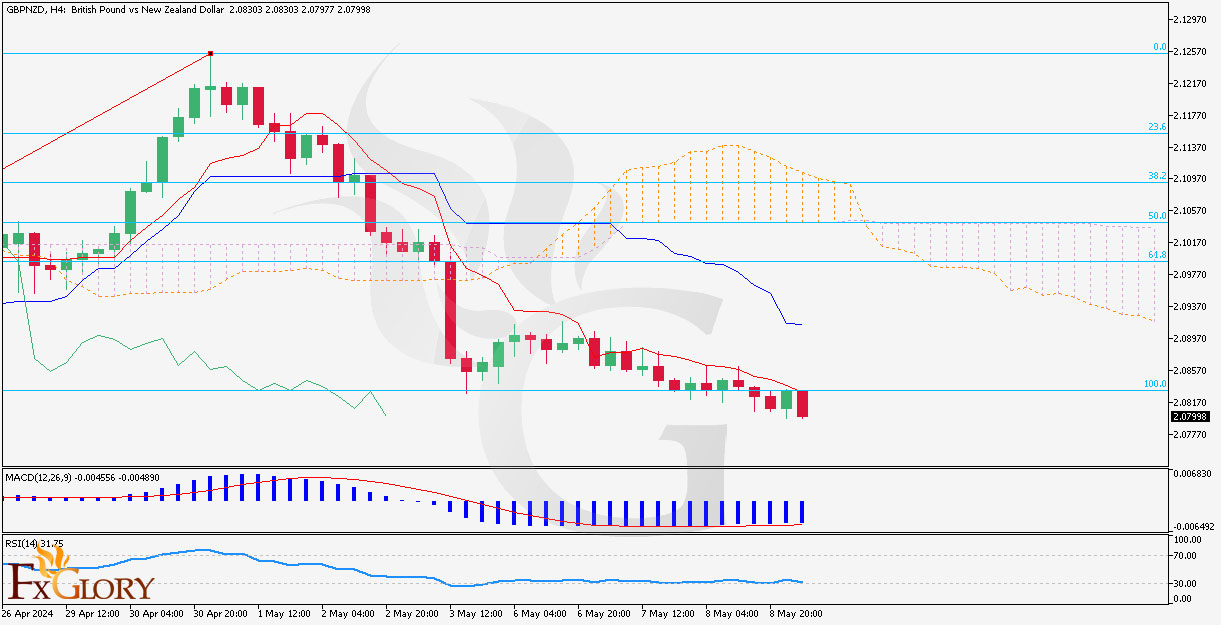

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The GBP/NZD analysis reflects the dynamic between the British Pound and the New Zealand Dollar. Today, key economic indicators such as the Official Bank Rate and speeches by BOE Governor Bailey may significantly influence GBP. The Bank Rate has aligned with forecasts in recent months, stabilizing expectations, but any deviation today could sway GBP value. The MPC's unanimous vote projection suggests a more hawkish monetary policy stance, which traditionally strengthens the currency.

Price Action Analysis:

In the H4 timeframe, the GBP/NZD price action analysis shows a volatile trend with recent bullish momentum. The formation of a series of higher lows over the past sessions suggests an upward corrective movement within a broader bearish context. The price is currently testing a key resistance level, and the reaction here will indicate whether the bullish sentiment can sustain.

Key Technical Indicators:

Ichimoku Cloud: The price is approaching the lower boundary of the Ichimoku cloud, indicating potential resistance. If the price breaks through, it may signal a stronger bullish trend reversal.

MACD (Moving Average Convergence Divergence): The MACD line is above the signal line but still below zero, indicating improving bullish momentum yet within an overall bearish trend.

RSI (Relative Strength Index): The RSI is above 50, suggesting increased buying momentum, but is not yet indicating overbought conditions, allowing room for further upside.

Fibonacci Retracement: Key Fibonacci levels from recent highs to lows show the price nearing the 61.8% retracement level, which may act as significant resistance.

Support and Resistance:

Support: The recent swing low around 1.9280 serves as the primary support level.

Resistance: Immediate resistance is found near the 61.8% Fibonacci retracement level at 1.9500.

Conclusion and Consideration:

The GBPNZD analysis is currently experiencing a bullish correction within a larger bearish trend on the H4 chart. The upcoming economic announcements and BOE Governor Bailey's speech could heavily impact GBP strength. Traders should monitor these events closely, as any hawkish surprise could reinforce the bullish trend. However, the presence near significant resistance levels suggests caution, with potential reversal risks if the bullish momentum cannot sustain.

Disclaimer: The provided GBPNZD chart forecast is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.

FxGlory

09.05.2024

Time Zone: GMT +3

Time Frame: 4 Hours (H4)

Fundamental Analysis:

The GBP/NZD analysis reflects the dynamic between the British Pound and the New Zealand Dollar. Today, key economic indicators such as the Official Bank Rate and speeches by BOE Governor Bailey may significantly influence GBP. The Bank Rate has aligned with forecasts in recent months, stabilizing expectations, but any deviation today could sway GBP value. The MPC's unanimous vote projection suggests a more hawkish monetary policy stance, which traditionally strengthens the currency.

Price Action Analysis:

In the H4 timeframe, the GBP/NZD price action analysis shows a volatile trend with recent bullish momentum. The formation of a series of higher lows over the past sessions suggests an upward corrective movement within a broader bearish context. The price is currently testing a key resistance level, and the reaction here will indicate whether the bullish sentiment can sustain.

Key Technical Indicators:

Ichimoku Cloud: The price is approaching the lower boundary of the Ichimoku cloud, indicating potential resistance. If the price breaks through, it may signal a stronger bullish trend reversal.

MACD (Moving Average Convergence Divergence): The MACD line is above the signal line but still below zero, indicating improving bullish momentum yet within an overall bearish trend.

RSI (Relative Strength Index): The RSI is above 50, suggesting increased buying momentum, but is not yet indicating overbought conditions, allowing room for further upside.

Fibonacci Retracement: Key Fibonacci levels from recent highs to lows show the price nearing the 61.8% retracement level, which may act as significant resistance.

Support and Resistance:

Support: The recent swing low around 1.9280 serves as the primary support level.

Resistance: Immediate resistance is found near the 61.8% Fibonacci retracement level at 1.9500.

Conclusion and Consideration:

The GBPNZD analysis is currently experiencing a bullish correction within a larger bearish trend on the H4 chart. The upcoming economic announcements and BOE Governor Bailey's speech could heavily impact GBP strength. Traders should monitor these events closely, as any hawkish surprise could reinforce the bullish trend. However, the presence near significant resistance levels suggests caution, with potential reversal risks if the bullish momentum cannot sustain.

Disclaimer: The provided GBPNZD chart forecast is for informational purposes only and does not constitute investment advice. Traders should conduct their own research and analysis before making any trading decisions.

FxGlory

09.05.2024